If you’ve ever shopped at a clothing store, you’ve likely been pitched to sign up for their store credit or charge card. While these cards can have nice perks, they sometimes come with high fees or limitations too. One popular option is the Kohl’s Charge Card, offered to Kohl’s customers. This card boasts benefits like cash back, monthly free shipping, and other discounts. But is it worth it? In this article, we’ll break down the pros and cons of Kohl’s Charge Card to see if it’s a good fit for you as a customer.

About Kohls Credit Card

Kohl’s is a prominent department store chain that has carved out its place as a family-friendly retailer offering quality items at affordable prices. Launched in 1986, Kohl’s has become the second-largest retail chain sales-wise, just behind Macy’s Inc. Known for frequent discount promos, with coupons often bringing significant savings, Kohl’s has earned a loyal customer base.

The Kohl’s Charge Card is made exclusively for Kohl’s shoppers. Aimed at frequent shoppers, this store card can be used at Kohl’s stores and online at Kohls.com. However, it’s essential to note that the Kohl’s Charge Card is most helpful for those who diligently pay off their balances monthly due to its relatively high variable APR of 30.74%.

For those looking to build credit responsibly, the Kohl’s Charge Card, with its use limited to Kohl’s stores, provides a controlled space for spending. Small, regular purchases paid off quickly can positively impact your credit score.

Deciding if the Kohl’s Charge Card is right for you depends on your financial situation, spending habits, and goals. However, individuals who rarely shop at Kohl’s may find better value in a general cash-back rewards credit card. Consider your preferences and needs before deciding if the Kohl’s Charge Card deserves a spot in your wallet.

Kohl’s Charge Card Rewards Structure

The Kohl’s Charge Card boasts a straightforward and rewarding setup that can significantly boost your shopping experience at Kohl’s. Whether you’re a frequent visitor or an occasional shopper, understanding the rewards structure can help you maximize the perks offered by this store card. Let’s dive into the key parts of the Kohl’s Charge Card rewards:

7.5% Cash Back on Every Purchase:

Enjoy a 7.5% cash back reward on every purchase made with your Kohl’s Charge Card. This provides a consistent and attractive cash-back rate, adding to overall savings.

35% Off First Purchase Within 14 Days:

New card holders get an exclusive bonus – a big 35% discount on their first purchase within 14 days of approval. This initial discount is a powerful incentive for new users.

$10 for Every $50 Spent During Kohl’s Cash Earn Periods:

Earn $10 in Kohl’s Cash for every $50 spent during Kohl’s Cash earn periods. This feature piles on extra savings, letting you accumulate Kohl’s Cash for future purchases.

Extra Savings Coupons:

The Kohl’s Charge Card offers access to additional savings through extra savings coupons. These coupons may provide percentage or dollar discounts on specific items or categories.

Receipt-Free Returns on Purchases:

Enjoy the ease of receipt-free returns on your Kohl’s Charge Card purchases. This simplifies the return process, making it hassle-free for cardholders.

Monthly Free Shipping Opportunities:

Card members may get monthly chances for free shipping on their purchases. This perk adds value for online shoppers who appreciate doorstep delivery.

Combine Kohl’s Card Benefits with Kohl’s Cash:

One unique advantage is the ability to combine Kohl’s Charge Card perks with Kohl’s Cash during earning periods. This means you can stack savings, potentially unlocking big discounts during special offers and promos.

Additional Hidden Perks with Kohl’s Charge Card

Beyond the standard rewards setup, the Kohl’s Charge Card often surprises cardholders with extra hidden perks. These perks are usually part of limited-time promos, offering additional incentives to enhance the overall shopping experience. Here’s a closer look at some of the extra hidden perks cardholders may enjoy:

Exclusive Discounts:

Limited-time promos may introduce exclusive discounts for Kohl’s Charge Card users. These could be percentage discounts on specific purchases or flat dollar discounts on certain items or categories.

Special Anniversary Offers:

Card holders might get special offers or discounts to celebrate their card anniversary. These anniversary perks vary and may include extra savings, exclusive promos, or bonus rewards.

Bonus Rewards for Specific Spending Items:

Periodically, Kohl’s may offer bonus rewards or incentives tied to specific spending categories or items. This could mean earning extra Kohl’s Cash, additional discounts, or special rewards for targeted buys.

Enhanced Kohl’s Cash Rewards:

While Kohl’s Cash is already part of the standard rewards, hidden perks might involve boosted Kohl’s Cash rewards during select promos. This means earning more Kohl’s Cash for your eligible purchases.

Exclusive Access to Sales and Events:

Kohl’s Charge Card users may get exclusive access to sales events or promos not available to regular shoppers. This exclusivity can provide early access to discounts and new arrivals.

Surprise Bonus Rewards:

Some promos may introduce surprise bonus rewards for Kohl’s Charge Card members. These could include additional discounts, extra savings on specific products, or other unexpected rewards.

In the end, the Kohl’s Card is comparable to other retail store cards regarding features, benefits, and costs. Adding a retail store card could help build your credit, though a secured credit card may be a smarter choice if you can handle the initial deposit. Before applying for the Kohl’s Charge Card or any other retail card, think about how often you’ll use it and your likelihood of paying the balance off in full to avoid steep interest fees. While the discounts and rewards may be enticing, the downsides of high APRs and limited acceptance can diminish the value if you don’t use the card responsibly.

Frequently Asked Questions:

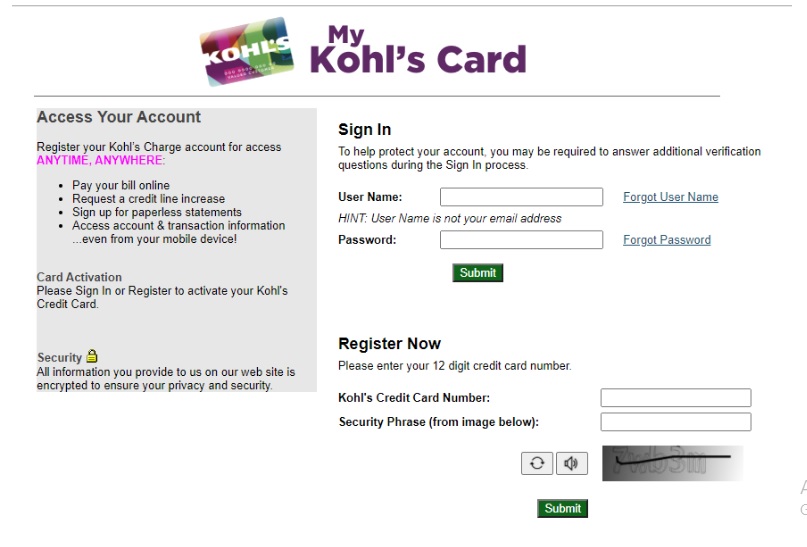

Q: How do I apply for the Kohl’s Credit Card?

A: You can easily apply for a Kohl’s Credit Card right on their official website. The online application is super user-friendly, and you can even check if you pre-qualify before applying.

Q: What are the main benefits of the Kohl’s Charge Card?

A: The Kohl’s Charge Card offers a bunch of nice benefits, including an initial discount on your first purchase, 7.5% cash back on every purchase, special discounts, Kohl’s Cash rewards, extra savings coupons, and monthly free shipping opportunities.